No one has really unified liquidity

Everyone says they are unifying liquidity though.

You’ve probably seen a lot of cross-chain protocols pop up over the past 2 years claiming to solve the issue of fragmented liquidity. Although it's with the right intentions, there seems to be some misrepresentation of what “unifying liquidity” means.

Ironically, the introduction of various bridges has in itself created further fragmentation, except the fragmentation is found deeper down in the stack.

The beginning of bridges

Before there were any cross-chain messaging layers, there were simple bridges that created wrapped assets. Most popular in 2019/ 2020 were Multichain & Wormhole.

At that time, this is what a user flow would look like:

- Bobby wants to send 1ETH from Ethereum to Solana

- Wormhole provided a simple interface for Bobby to lock 1 ETH on Ethereum

- Wormhole minted 1 wormholeETH on Solana

The same flow applied if Bobby were to use multichain, except instead of receiving wormholeETH, he would receive anyETH. As you would imagine, while wormholeETH and anyETH had the same value at that time, they were not fungible. Let’s assume Bobby wants to use XYZ dApp but the dapp only supported wormholeETH but Bobby only had anyETH. He would need to conduct a swap, which is another issue since there was no anyETH/wormholeETH pool, and routing this trade would result in a non-trivial loss after slippage and multiple fees.

Now imagine this time tens of other wrapped versions of many different assets with many dApps. It got sorta messy.

*Enter messaging layers*

The inefficiencies in the old bridging systems ushered in the era of messaging bridges. The point of the message bridges was to integrate at the dApps’ infrastructure level to abstract the bridging process away to a certain extent. Once integrated, the dApp would natively interact between different blockchains, removing the need for a user to bridge assets to interact with the dapp.

How messaging layers unify liquidity

Currently, when bridges refer to unified liquidity it generally looks something like this:

Using USDT and LayerZero as an example, we can see that all the dApps that have integrated LayerZero can interact seamlessly with the LayerzeroUSDT. This is because the USDT is wrapped in LayerZero’s token standard. These types of tokens are usually called OFT, Omnichain Fungible Tokens. Any token issuer can turn their token into an OFT on LayerZero.

This is all well and good, if there were only LayerZero and every dapp were to integrate with this messaging layer, which is far from the case.

Fragmentation at the cross-chain communication layer

Just like LayerZero, there are many cross-chain communication layers that dApps choose to integrate based on their preferences. Each messaging layer has its own OFT or token standard.

Using USDT as an example, we end up with an ecosystem looking something like this:

Which gives us this:

The above shows 3 different bridging ecosystems, each with their own version of USDT.

- dApps1,2 & 3 can only interact with layerzeroUSDT

- dApps 2,3 & 4 can only interact with AxelarUSDT

- dApps 5,6 & 7 can only interact with ccipUSDT

While only 3 examples are listed here, there are many messaging layers each offering similar outcomes, although they may vary in architecture design.

While it’s ambitious for each messaging layer to assume they can integrate every single dApp, it’s fair to say that messaging layers should be treated like layer 1s. There will always be a superior or most popular one, but there will always be others as well.

Unified liquidity is a spectrum

As with most things in crypto, unified liquidity can be a spectrum. In our examples above, liquidity is unified amongst a group of dapps, but not between all of them.

OFTs are an exciting development for bridge-specific ecosystems such as Axelar or LayerZero, but it is ultimately not the end game for truly unified ecosystems.

Unified liquidity should have one main property;

- Omni-fungible: A single asset should be interchangeable irrespective of which ecosystem or chain it resides on. For example, USDT within LayerZero’s ecosystem should be interchangeable with USDT in the Axelar ecosystem.

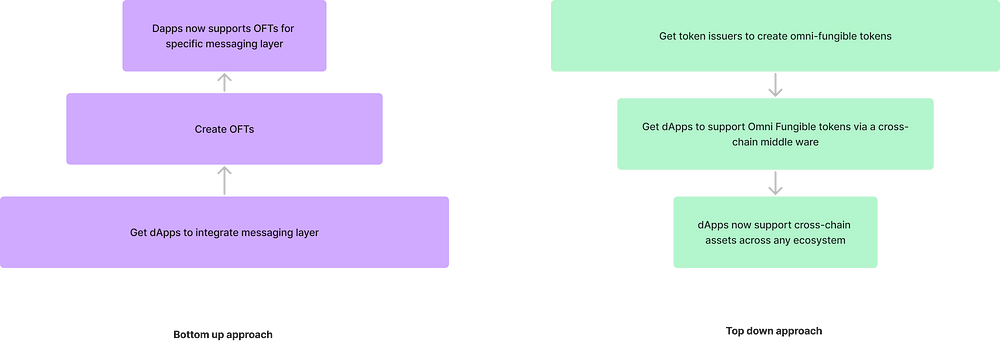

Achieving this is rather difficult because it changes the direction of development. Currently, messaging layers are building from a bottom-up approach by focusing on dApps to integrate their cross-chain system first.

If we flip this to a top-down approach, cross-chain systems would need to focus on token issuers making their tokens omni-fungible via some standard.

Of course, this diagram is overly simplified and doesn’t account for the complete systematic change a messaging layer would need to conduct to make this possible.

In part 2 of this article, we’ll explore potential ways on how we can solve for ? on our unified spectrum

If you have thoughts on the cross-chain liquidity please feel free to reach out on Twitter @0xKimberly!